Professional Tax Registration Services

Instituted by the State, Professional Tax (PT) is levied on the income earned by the employees for delivering their services. Legal251 experts will help you get Registered under Professional Tax online.

Professional Tax is a State Government imposed tax levied on the employee's income or earnings based

on professions such as a lawyer, CAs or doctors, and is mandatory for almost everyone.

Get

connected with our experts to register you for professional tax today!

Book Service Now

@ ₹ 2251.00 only /- ( Including GST )

Name *

Contact Number *

Email *

City/district *

Category *

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

Professional Tax is imposed on all salaried individuals by the state government and applies to all

working professionals. It is levied on the particular individual's trade, profession or employment.

The tax rate differs according to the state. However, the maximum amount charged as professional tax

is Rs.2500 per year. To learn more about Professional Tax and Professional Tax Registration, contact

the professionals of Legal251 and they will help you get your PTR done. When employing staff for a

business, the Professional Registration Certificate application should be submitted to the state tax

department within 30 days of employing staff. If the business operates in multiple locations,

separate applications must be made to each relevant authority corresponding to the jurisdiction of

each workplace.

Professional Tax Return Filing and Payment

Professional Tax Return Filing and Payment

The entities and individuals registered under Professional Tax registration are obligated to file professional tax returns regularly and pay the payable taxes within the prescribed period, which are typically on a monthly or annual basis, depending on the state regulations.

Professional Tax filing is a statutory obligation made by state governments across India. This filing process includes the declaration and remittance of the collected professional tax amount.

The digitalization of tax setup in India has rationalized Professional Tax filing. Many departments of state concerning tax offer e-platforms for convenient and efficient filing. These e-portals concerning tax departments facilitate easy submission of returns.

Following are some points that are to be considered while complying with Tax returns

-

Pay professional tax on time

-

Obtain professional tax registration

-

Ensure accurate documentation

-

Double-check all data entered while filing to claim exemptions

-

Seek advice from tax experts or chartered accountants

Professional Tax Slab

Professional Tax Slab

The government of the state imposes professional tax and rate for the same varies from state to state, but a common slab structure is based on income to pay professional tax. Article 276 of the Constitution of India gives the state government authority to impose professional tax. The highest limit set out in Article 276 is Rs.2500.

Monthly Salary (Gross)

Professional Tax (p.m.)

For the State of Karnataka

Up to INR 15,000

INR 15,001 and or above

Nil

Rs. 200

For the State of Telangana

Up to Rs. 15000

From Rs. 15,000-20,000

Above Rs. 20,000

Nil

Rupees 150

Rupees 200

For the State of Maharashtra

Up to Rs. 7,500 (men)

Up to Rs. 10,000 (women)

Rs.7,500 to Rs. 10,000

Rs. 10,000 and above

Nil

Nil

Rupees 175

Rupees 200 (Rupees 300 for February)

Professional Tax Registration Across India

Professional Tax Registration Across India

The taxation system in India is vast and landscape, imposing various types of taxes on individuals and businesses. Professional Tax is a state-level tax applied to professionals, which is an essential legal requirement to be fulfilled by professionals operating in India. The tax amount varies from state to state and is imposed based on predetermined slabs.

Professional Tax Registration is mandatory for employers and individuals falling under the slabs of the Professional Tax Act. The registration under the professional tax complies with the tax regulations and ensures the legitimate operations of professionals within the country.

This tax is a vital aspect of the taxation framework prevailing in India, which is a state tax on professions. Understanding the fine distinction of Professional Tax and fulfilling the registration and tax payment obligations are important for smooth legal compliance among the professions prevailing in the country.

Enrolment for PT Registration with Legal251

Enrolment for PT Registration with Legal251

-

Registration Process

You have to follow the registration process on our official platform. It will only require your name, e-mail address, contact number, and service details.

-

Documentation Process

Following the registration process, you will be required to submit all the necessary documents for the service purchased by you. In case you don't have the necessary documents, then we will also assist you with the same.

-

Operational Process

Our team will provide the best-in-market operational processing while you sign into our service. We’ll assist you with a hassle-free operational work process.

-

The Final Process

After the successful completion of all the operational processes, we'll provide you with the final results. Within just a few working days, you’ll be a valuable client of Legal251.

How to obtain Professional Tax Registration

How to obtain Professional Tax Registration

States impose this tax based on income and practice. The doorstep for registration can vary across states.

This Registration is typically conducted online through the respective state government's official website.

The segments are filled with information which usually includes details regarding income, profession, and other relevant particulars.

It's important to note that the PT registration process may differ from state to state, therefore, it is Important to choose the appropriate state.

After successful registration, one will be issued a PT Certificate, which serves as proof of compliance with the state's tax laws.

List of Documents Required

List of Documents Required

-

Enrolment Certificate of Incorporation or LLP Agreement in case of Limited Liability Partnership

-

Memorandum of Association (MOA) and Articles of Association (AOA)

-

PAN Card

-

NOC (if applicable)

-

Passport size photo

-

Address proof of business owner

-

Details of employees and salary or wages paid

-

Other registrations or licenses (if any)

FAQs on Professional Tax Registration

FAQs on Professional Tax Registration

The tax deduction process includes calculating the tax according to the law, based on the employee's income and deducting it from their monthly salary.

Yes, and the eligibility criteria may include factors such as income level, age and profession.

Exemption criteria are usually available on the official government website. one can search for specific forms related to exemptions on the website or contact the local taxation department for further information.

Individuals can pay tax by opting for the relevant form, from the government's official website. Further filling out the relevant form with accurate information and submitting the same.

Due dates for professional tax payments are notified by your concerned state government. It is also important to keep in mind that Late payment of the tax might attract penalties.

To determine whether you are eligible for professional tax payment or not, you need to refer to the specific guidelines notified by your state government i.e. where your business or profession is situated.

THEY TRUST US

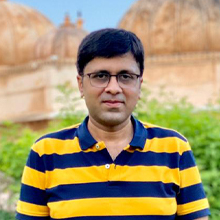

Mr. Rajat Maheshwari

Director Rajat Gems & Jewellery Pvt. Ltd.

Legal251 is

the

best platform for getting consultancy be it in any legal domain they provide

best solution for your query.I am satisfied with their work. What i was

expecting i

got it from Legal251. And I would really appreciate their cooperative work and

how

they deal and cooperate with their customers.

They are the best in business as you may know. There are many complications in

Filing

GST & Income Tax returns for jewellery supply & design business they make all

these

very easy and

efficient.

Mr. Chirag Jain

Director Samrudhi Innovation

For people

like

us who are surrounded by work, legal251 is like a gift. Be it a busy day or a

deadline, legal251 can always be counted upon. The customer service is always up

to

the mark and the advices and solutions are always promising. Within 48 hrs of

the

query you can have your solution in your hand and all this, just a few clicks

away

and inside your pocket. Legal work is now on a whole different level.

Mr. Sachin Karma

Co-Founder Today's Bharat

Legal251

changes

the very idea which most people have about getting any legal work done. Making

the

whole process so convenient and also online makes it so easy for everyone to

work

with. If talking about quality work, they have absolutely no match. A platform

as

big as Today's Bharat required a very complete and descriptive terms of

condition

and privacy policy. This was greatly achieved with the help of experts at

Legal251.

Mr. Vipin Soni

Well Known Financial Consultant

I'm thrilled to share my exceptional experience with

LEGAL251. Their top priority is evident: providing the best and speediest

solutions.

Their professionalism and expertise stood out. The remarkable speed at which

LEGAL251 operates truly sets them apart. Their responses were prompt and packed

with insightful guidance. Any queries I had were addressed immediately. For

those

seeking legal assistance that's efficient and of the highest quality, I

wholeheartedly endorse LEGAL251.

Why Choose Legal251 for your Professional Tax Registration

Why Choose Legal251 for your Professional Tax Registration

Convenient Professional Tax Registration

With Legal251 users can easily register for our service just by filling his/her name, email ID, contact number and required service. After your registration at our platform, our team will contact you and further move with your professional tax registration.

Best Online Platform

Legal251 has one of the biggest client bases, thus it makes us one of the best online platforms in India, which can help you with your Professional Tax Registration. It doesn't matter where you are, we are ready to serve you online.

Best Customer Support

The legal251 team is also known for its complete support and assistance among its clients. We not only will support you after your registration but we also appreciate your feedback for further improvement.

Experienced Team

Register for professional tax with an experienced team as we already have more than 10 years of experience. Thus, choosing us will benefit you by working with experienced experts throughout India, which will ease and smooth the process of your Registration.

On-time Service

Our team is ready to provide you with on-time service without any delay. We know the value of your time thus our team works effectively on your service and provides you with a registration certificate as soon as possible.

Pocket-friendly Services

We offer nominal and pocket-friendly PT Registration service without any compromise on the quality of the work. With your every investment in our service, we make sure that your satisfaction and budget are our priority.

We are here to help you! Chat with us on WhatsApp for any discount queries or more.