200k+ people trust

us

200k+ people trust

us

One Person Company (OPC) Registration

Get OPC Registration

@

Rs.8751 only /- ( Including GST)Terms & Condition

Government fees & stamp duties extra. Please fill form to get detailed quote in seconds.

In 2 Weeks . Transparent Pricing . No Hidden Cost

Get Absolutely Free In Package

Pan & TAN Registration

DIN and DSC for Director

Complete Documentation

Personal Assistance

PF and ESIC Registration

Get Quote Instantly

Name *

Contact Number *

Email *

City/district *

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

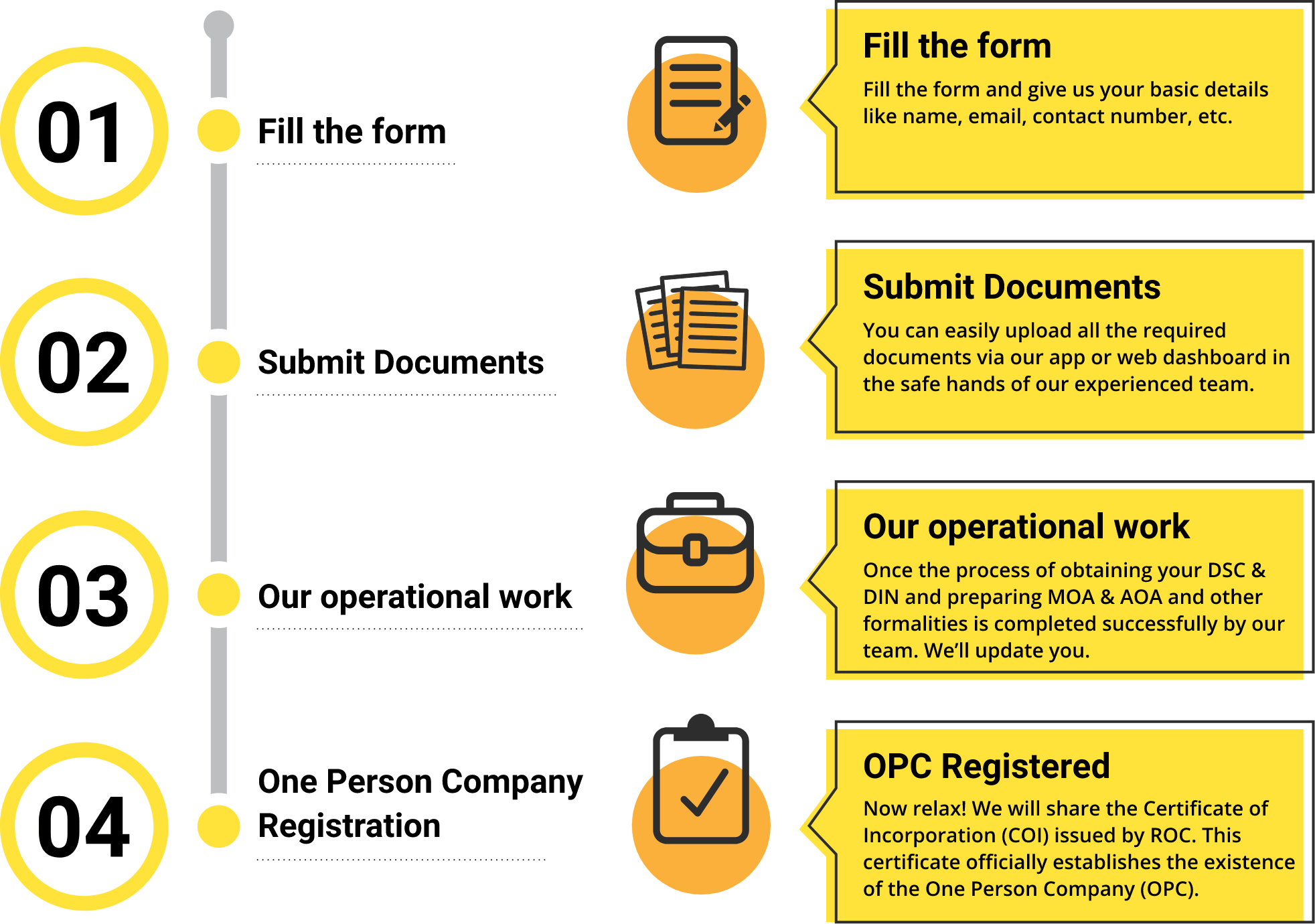

Are you ready to start a company but want to avoid creating it with others? Don't worry! One Person Company (OPC) in India is a new concept introduced with the Companies Act 2013. As per section 2(62) of the Company's Act 2013, a company can be formed with just one director and one member.

The director and member can be the same person. It is a form of a company where the compliance requirements are lesser than that of a private company. Thus, one individual who may be a resident or NRI can incorporate their business with a company's features and the benefits of a sole proprietorship.

What are you waiting for? Register your Person Company from Legal251 now! Our experienced team will handle everything for you, from paperwork to verifying documents, so you can enjoy knowing your business is in good hands. Start your company with Legal 251 and take that first step to success!

All Service Comparison

Proprietorship vs Limited Liability Partnership (LLP) vs Company

Features

Proprietorship

Partnership

LLP

Company

Definition

A sole proprietorship is a business owned and operated by a single individual.

A partnership is a legal arrangement where two or more individuals or entities agree to share ownership, responsibilities, profits, and liabilities of a business.

An LLP is a hybrid business structure that combines elements of partnerships and company. It offers limited liability to its partners, protecting their personal assets from the liabilities of the business.

A company is a legal entity that exists separately from its owners (shareholders). It can be a private limited company or a public limited company. Shareholders' are the owners of the company and their liability is limited to their investment, and the company's operations and management are governed by the board of directors.

Ownership

In a proprietorship, a single individual owns and manages the business.

A partnership involves two or more individuals (partners) who share ownership and management responsibilities.

Partners have limited liability, meaning their personal assets are generally protected from business debts or liabilities.

A company is a legal entity separate from its owners (shareholders). Shareholders have limited liability, and their personal assets are not typically at risk for company debts.

Registration Time

7-15 working days

Promoter Liability

Unlimited Liability

Limited Liability

Governance

Governed by Local Laws

Under Partnership Act, 1932

LLP Act, 2008

Under Companies Act,2013

Compliance Requirements

Compliance in accordance with- Income Tax Laws and other Local Laws

Compliance in accordance with- Income Tax Laws and other Local Laws

Compliance in accordance with-Income Tax Laws, Local Laws, Companies Act and other as applicable

Compliance in accordance with-Income Tax Laws, Local Laws, Companies Act and other as applicable

Taxation

Income is taxed at the individual's income tax rates.

Income is generally taxed at the individual partners' income tax rates.

Taxed as a partnership, where partners are individually taxed on their share of profits.

Subject to corporate tax rates. Shareholders are taxed on dividends received.

Limited Liability

The biggest advantage of OPC registration is that it provides limited liability protection to the sole member. This means that the personal assets of the member are separate from the company's liabilities. In case of any financial losses or legal liabilities, the member's personal assets remain protected.

Single Ownership and Management

OPC allows a single individual to form and manage a company. This is beneficial for entrepreneurs who want to start a business on their own without the need for additional shareholders or partners. The sole member has complete control over the company's operations and decision-making process.

Separate Legal Entity

OPC is considered a separate legal entity from its owner. It has its own identity, distinct from the individual member. This provides credibility and enhances the business's image, making it easier to enter into contracts, raise funds, and establish business relationships.

Perpetual Succession

OPC registration ensures perpetual succession, which means the company continues to exist even if the owner or promoter passes away or becomes incapacitated. The shares of the company can be transferred to a nominee mentioned in the incorporation documents, ensuring the continuity of the business.

Easy Funding and Bank Loans

OPCs have better access to funding and bank loans compared to sole proprietorships or partnerships. Financial institutions and investors find OPCs more trustworthy and are more willing to provide financial assistance. OPCs can raise funds through equity or debt and have the option to issue shares to investors.

Tax Advantages

OPCs enjoy certain tax benefits. They are eligible for tax deductions, exemptions, and benefits available to other types of companies. OPCs are taxed at the corporate tax rate, which may be lower than individual tax rates, resulting in potential tax savings.

Minimal Compliance Requirements

Compared to other types of companies, OPCs have relatively fewer compliance requirements. They are exempted from certain statutory obligations applicable to other companies, such as holding annual general meetings (AGMs) with shareholders.

Easy Conversion

As an OPC grows, it can be converted into a private limited company, which offers additional benefits such as the ability to have more shareholders and increased capital. The conversion process is straightforward and provides flexibility for future expansion.

L ve From

ve From

Our Clients

Our customers love the convenience of filing with us and appreciate our expertise in getting their Legal work done on time. We value the trust our clients place in us, and we strive to provide them with the best service possible.

Kailash Chandra Verma

Proprietor , Balaji Apparels

"Amazing Platform"

Filing my GST returns had been an absolute nightmare until I found Legal251. The interface is so easy to use, it makes filing my returns on time a breeze. I can easily keep track of all my invoices and payments and Legal251 experts even provides helpful tips for me to make sure that everything is done correctly. Thanks to Legal251 team, filing GST returns has become stress-free!

Virendra Vishwkarma

Founder, Tirth Enterprises

"Highly recommended!"

I was having a hard time filing my GST returns and was really confused as to how to go about it. That's when I came across Legal251. They were thorough professionals who made sure that my documents were filed perfectly without any errors. Their customer service was also top-notch and they guided me through the entire process with ease. I'm glad that I chose Legal251 for filing my GST returns. Highly recommended!

Priyanka Agnihotri

CEO, 9 Telecom and Security

"Extremely Impressed"

I've been using Legal251 for filing my GST returns for the past few months and I'm extremely impressed with their service and platform. It's so easy to use, and all the necessary information is provided in a very organized way. Plus, filing my returns on time has become so much easier with this platform. Highly recommend Legal251 for anyone looking for an efficient way to file their GST returns.

Monu Panchal

Founder , Mishi Industries

"Excellent Knowledge "

I was a bit worried when filing my GST return for the first time, but Legal251 made it a breeze. Their team of experts guided me through every step and filed my return perfectly. I'm really glad I chose Legal251 to help me with this task as they have an excellent knowledge of the regulations and ensured that everything was done correctly. Thank you!

FREQUENTLY ASKED QUESTIONS

Growth & Improvement

We believe in growth and improvement at all costs. For us, growth is the law of life and it shall be fulfilled. We know the importance of business and its growth for you.

Support & Availability

We feel how much pain even a small problem or query can cause, that is the reason we are available to support you and solve any of such problems at every particular instance in time.

Experienced Team

All the members of our team are experienced individuals who believe in professionalism and customer satisfaction above all. Each one of them is passionate in their respective fields.

Focus

Any assigned task is of utmost importance to us, that's why our team members are always focused on taking care of even the smallest of our clients' needs and requirements.

Value for Money

We understand that the money being spent is hard-earned, therefore we utilize every single penny that you pay us in the most effective way possible hence providing the best value for money.

Care & Regards

We believe you to be a part of this family and that all your problems, as well as achievements, are our very own. Your interests are ours and their fulfillment is at the top in our regards.

Hi we are Online!

We are here to help you! Chat with us on WhatsApp for any discount queries or more.