PF Registration Online

Register your Business for Provident Fund with the help of Legal251’s registration and compliance services and assure that your employees enjoy the benefit of their Provident Fund in post retirement or during any emergency

Be a responsible employer and register your company under

Employees Provident Fund Organization

(EPFO).

Provident Fund Registration is mandatory for every employer whose employee

strength is 20 or

more.

Book Service Now

@ ₹ 3251.00 only /- ( Including GST )

Name *

Contact Number *

Email *

City/district *

Category *

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

It is implemented by the Employees Provident Fund Organization and is one of the core savings

platforms in India for almost all people working in Government, Private or Public sector

organizations.

The Businesses shall complete its provident fund registration within One month from the date of

hiring the 20th employee.

It acts as the best way to provide financial, social & stability to the employees such as providing

medical assistance, retirement, education of children, insurance support and housing facilities for

the employees of an organization.

How to

apply

How to

apply

Common Mistakes to Avoid in PF Online Registration

Common Mistakes to Avoid in PF Online Registration

-

Failure to comply with eligibility criteria

-

Inaccurate or incomplete information in the application form

-

Non-submission of mandatory documents

-

Errors in the payment of fees

-

Delaying Registration

-

Expert Advice

-

Incorrect Employee Count

-

Inaccurate Salary Breakups

-

Overlooking Documentation

-

Not Updating Details Regularly

-

Ignoring Voluntary PF Contributions

-

Mishandling Grievances

-

Forgetting Online Facilities

-

Not Seeking Expert Help

Documents Required for PF Online Registration

Documents Required for PF Online Registration

These documents are required for Provident Fund registration:-

-

PAN Card of Proprietor/Partner/Director.

-

Address Proof

-

Aadhaar Card of Proprietor/Partner/Director.

-

Shop Establishment Certificate or GST Certificate

-

Digital Signature of the Proprietor/Partner/Director

-

Bank Statement

Benefits of Online PF Registration with Legal251

Benefits of Online PF Registration with Legal251

-

Risk coverage

-

Uniform account

-

Employee Pension Scheme

-

Long-term goals

-

Emergency needs

-

Tax Exemptions

-

Capital Appreciation

-

Insurance Benefits

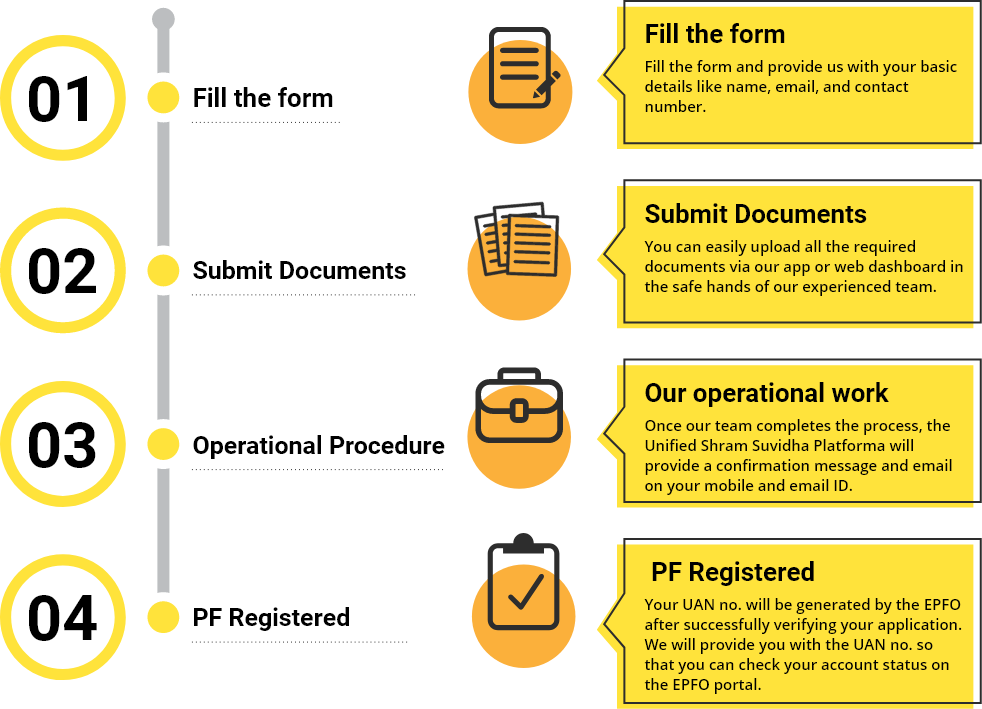

Online Registration: Step-by-Step

Guide

Online Registration: Step-by-Step

Guide

Our team will review the documents you have submitted, reviewing any false or mistaken information to keep you secure.

Our best PF experts are here to help you with document requirements and registration necessities.

The respective professional will move further with your documents to apply for your PF Registration.

After acceptance of the application, you will be registered through UAN. We will share the UAN no. with you & will also track the status of your PF account.

You are supposed to wait until our expert reaches out to notify you of the activation of your PF Account.

The Process of Online PF

Registration

The Process of Online PF

Registration

Visit the EPFO Portal

Select Establishment Type

Create User ID and Password

Submit the Required Documents

Generate and Submit the Registration Form

Receive Approval and Provident Fund Code

FAQs on PF Registration

FAQs on PF Registration

Both employer and employee contribute 12% each to the Provident Fund.

You can log into your PF account using your UAN number.

A minimum of 20 members/employees are needed to obtain EPF Registration in India.

No, you can apply to transfer your account online by submitting Form 13(R).

Yes, but the total contribution should not exceed 15,000 per month.

Both employee and employer contribute around 12% of the basic salary, which is the upper limit. However, you can add more to the PF account by contributing to VPF.

One needs a basic pay of less than Rs. 15,000 per month to be applicable for EPF.

All companies employing 20 or more employees are eligible or apply for the EPF scheme.

UAN or Universal Account Number is a 12-digit unique number allotted to every member by the department of EPFO. This specific number is permanent and valid for the member's entire life, and it does not change with the change of employment. The UAN number helps in the automatic transfer of Funds and PF withdrawals.

The EDLI benefits are payable to the eligible individuals to receive EPF dues.

THEY TRUST US

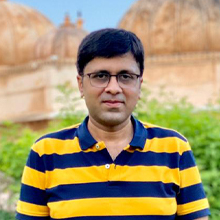

Mr. Rajat Maheshwari

Director Rajat Gems & Jewellery Pvt. Ltd.

Legal251 is

the

best platform for getting consultancy be it in any legal domain they provide

best solution for your query.I am satisfied with their work. What i was

expecting i

got it from Legal251. And I would really appreciate their cooperative work and

how

they deal and cooperate with their customers.

They are the best in business as you may know. There are many complications in

Filing

GST & Income Tax returns for jewellery supply & design business they make all

these

very easy and

efficient.

Mr. Chirag Jain

Director Samrudhi Innovation

For people

like

us who are surrounded by work, legal251 is like a gift. Be it a busy day, or a

deadline, legal251 can always be counted upon. The customer service is always up

to

the mark and the advices and solutions are always promising. Within 48 hrs of

the

query you can have your solution in your hand, and all this, just a few clicks

away

and inside your pocket. Legal work is now on a whole different level.

Mr. Sachin Karma

Co-Founder Today's Bharat

Legal251

changes

the very idea which most people have about getting any legal work done. Making

the

whole process so convenient and also online makes it so easy for everyone to

work

with. If talking about quality work, they have absolutely no match. A platform

as

big as Today's Bharat required a very complete and descriptive terms of

condition

and privacy policy. This was greatly achieved with the help of experts at

Legal251.

Mr. Vipin Soni

Well Known Financial Consultant

I'm thrilled to share my exceptional experience with

LEGAL251. Their top priority is evident: providing the best and speediest

solutions.

Their professionalism and expertise stood out. The remarkable speed at which

LEGAL251 operates truly sets them apart. Their responses were prompt, and packed

with insightful guidance. Any queries I had were addressed immediately. For

those

seeking legal assistance that's efficient and of the highest quality, I

wholeheartedly endorse LEGAL251.

Why Choose Legal251 for PF Registration?

Why Choose Legal251 for PF Registration?

Convenient Provident Fund Registration

With Legal251, users can easily register online just by filling his/her name, email ID, contact number and choosing Provident Fund registration services. After your online registration, our team will contact you and move further with the required process.

Best Online Platform

Legal251 has one of the biggest online client bases, making us one of the Best Online Platforms in India, which will help you in getting your Provident Fund registration in no time. It doesn't matter where you are, we are ready to serve you online

Best Customer Support

The legal251 team is also known for its complete support and assistance among its clients. We will not only support you after getting your registration but we also appreciate your feedback.

Experienced Team

We are well versed with providing Provident Fund registration as with 10 years of experience in the industry. So, choosing us will always benefit you by working with the best experts, this will ease and smoothen up the process of the registration.

On-time Service

Our Team is always ready to provide you with on-time service. We know the value of your time so without wasting any time we immediately start working on your Provident Fund Registration.

Pocket-friendly Services

We provide nominal and pocket-friendly services without compromising on the quality of work. With your every investment in us, we make sure that your satisfaction and budget are our priority.

We are here to help you! Chat with us on WhatsApp for any discount queries or more.