200k+ people trust

us

200k+ people trust

us

Income Tax Audit consultancy

At Legal251, we understand the intricate complexities of the Indian taxation system, and we specialise in providing expert Income Tax Audit consultancy services to ensure your financial compliance is seamless and efficient. Our dedicated team of professionals is committed to delivering comprehensive solutions tailored to your unique business needs.

Get Quote Instantly

Name *

Contact Number *

Email *

City/district *

0 Years

Of Experience

0 +

Cases Solved

0 +

Awards Gained

0 k +

Trusted Clients

0 k+

Queries Solved

Income Tax Audit consultancy

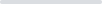

An Income Tax Audit is a critical evaluation of a taxpayer's financial records, transactions, and statements to verify their accuracy and adherence to the provisions of the Income Tax Act, 1961. It is a mandatory process imposed by the Income Tax Department of India on various entities, including individuals, businesses, and organisations, whose total turnover or gross receipts exceed the specified threshold limits. The primary objective of an Income Tax Audit is to ensure transparency, prevent tax evasion, and maintain the credibility of the taxation system.

Navigating the complexities of Income Tax Audits in India can be a daunting task. Let the experts at Legal251 guide you through the process, ensuring accuracy, compliance, and peace of mind. Reach out to us today to schedule a consultation and discover how our specialised consultancy services can benefit your business.

.svg)

Accurate Financial Assessment

An accurate financial assessment is crucial to avoid discrepancies and penalties during the audit process. Our experts at Legal251 meticulously review your financial records, transactions, and statements to ensure accuracy and consistency.

Expert Interpretation of Tax Laws

Navigating the complex web of tax laws requires expertise. Our consultants provide expert interpretations, ensuring you comply with the latest regulations while minimising tax liabilities.

Minimised Tax Liabilities

Through strategic planning and utilisation of available deductions and exemptions, you can significantly reduce your tax liabilities. Effective tax planning can save you substantial amounts of money.

Timely Compliance

Timely submission of audit reports and related documents is critical to avoid penalties and legal issues. Compliance ensures that your business operations remain uninterrupted.

Reduced Risk of Penalties

Non-compliance with audit regulations can lead to substantial penalties and legal complications. A consultancy service helps you avoid such risks by ensuring you meet all necessary requirements.

Strategic Business Decisions

The insights gained during the audit process can provide valuable information for making informed business decisions and improvements. We help you leverage the data from the audit to make strategic decisions that can enhance your business's overall performance.

Stress-Free Audit Experience

The audit process can be stressful, but with professional consultancy, you can navigate it confidently, knowing that experts are handling the intricacies. Our client-focused approach ensures that you have a smooth and stress-free audit experience.

Comprehensive Record-Keeping

Proper record-keeping is essential for a successful audit. A consultancy service ensures that your financial records are organised and maintained according to audit standards.

Customised Audit Approach

Every business is unique, and a one-size-fits-all approach to audits may not be suitable. Consultancy services customise the audit strategy to match your specific business operations.

Legal and Regulatory Compliance

Staying compliant with the ever-evolving tax laws and regulations is essential to avoid legal troubles. A consultancy service ensures that your business aligns with the latest requirements.

L ve From

ve From

Our Clients

Our customers love the convenience of filing with us and appreciate our expertise in getting their Legal work done on time. We value the trust our clients place in us, and we strive to provide them with the best service possible.

Kailash Chandra Verma

Proprietor , Balaji Apparels

"Amazing Platform"

Filing my GST returns had been an absolute nightmare until I found Legal251. The interface is so easy to use, it makes filing my returns on time a breeze. I can easily keep track of all my invoices and payments and Legal251 experts even provides helpful tips for me to make sure that everything is done correctly. Thanks to Legal251 team, filing GST returns has become stress-free!

Virendra Vishwkarma

Founder, Tirth Enterprises

"Highly recommended!"

I was having a hard time filing my GST returns and was really confused as to how to go about it. That's when I came across Legal251. They were thorough professionals who made sure that my documents were filed perfectly without any errors. Their customer service was also top-notch and they guided me through the entire process with ease. I'm glad that I chose Legal251 for filing my GST returns. Highly recommended!

Priyanka Agnihotri

CEO, 9 Telecom and Security

"Extremely Impressed"

I've been using Legal251 for filing my GST returns for the past few months and I'm extremely impressed with their service and platform. It's so easy to use, and all the necessary information is provided in a very organized way. Plus, filing my returns on time has become so much easier with this platform. Highly recommend Legal251 for anyone looking for an efficient way to file their GST returns.

Monu Panchal

Founder , Mishi Industries

"Excellent Knowledge "

I was a bit worried when filing my GST return for the first time, but Legal251 made it a breeze. Their team of experts guided me through every step and filed my return perfectly. I'm really glad I chose Legal251 to help me with this task as they have an excellent knowledge of the regulations and ensured that everything was done correctly. Thank you!

FREQUENTLY ASKED QUESTIONS

Growth & Improvement

We believe in growth and improvement at all costs. For us, growth is the law of life and it shall be fulfilled. We know the importance of business and its growth for you.

Support & Availability

We feel how much pain even a small problem or query can cause, that is the reason we are available to support you and solve any of such problems at every particular instance in time.

Experienced Team

All the members of our team are experienced individuals who believe in professionalism and customer satisfaction above all. Each one of them is passionate in their respective fields.

Focus

Any assigned task is of utmost importance to us, that's why our team members are always focused on taking care of even the smallest of our clients' needs and requirements.

Value for Money

We understand that the money being spent is hard-earned, therefore we utilize every single penny that you pay us in the most effective way possible hence providing the best value for money.

Care & Regards

We believe you to be a part of this family and that all your problems, as well as achievements, are our very own. Your interests are ours and their fulfillment is at the top in our regards.