Introduction:

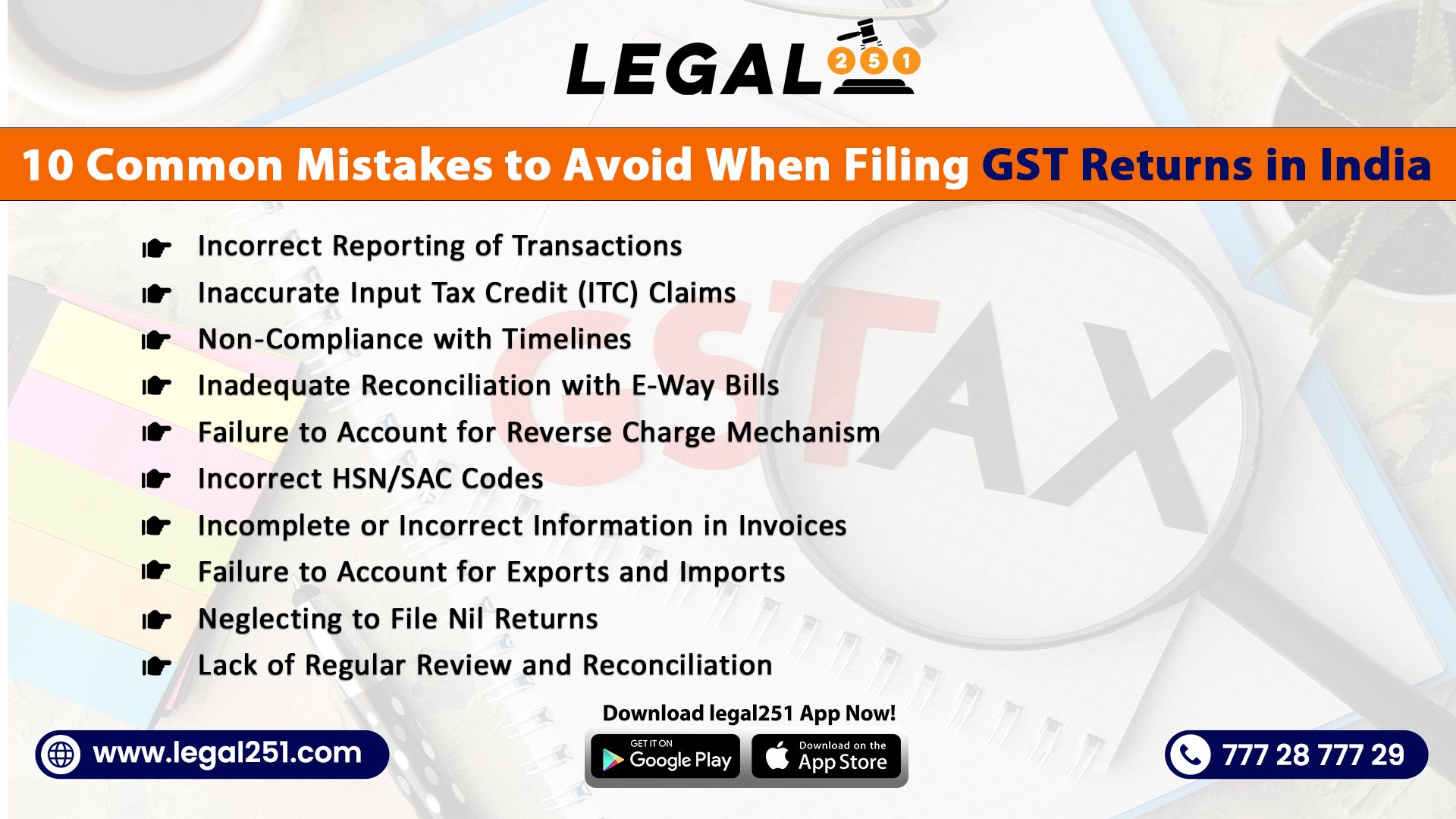

Goods and Services Tax (GST) is a comprehensive indirect tax introduced in India to streamline the taxation system. Filing GST returns accurately and timely is crucial for businesses to comply with the law and avoid penalties. However, many taxpayers make common errors that can lead to unnecessary complications and financial liabilities.

In this article, we will discuss ten common mistakes to avoid when filing GST returns in India, providing valuable insights to help businesses navigate the GST liability effectively and stay compliant.

-

Incorrect Reporting of Transactions:

One of the most common mistakes taxpayers make when filing GST returns in India is the incorrect reporting of transactions. Accurate reporting of all sales, purchases, and expenses is crucial for maintaining GST compliance. Failing to report transactions or misreporting them can lead to discrepancies in the GST return, inviting the attention of tax authorities and potential penalties.

To avoid this mistake, businesses must ensure that they maintain proper documentation, including invoices, receipts, and purchase orders, to support the reported transactions. It is essential to record all transactions accurately, ensuring that the details match the corresponding invoices and financial records.

Regular reviews and reconciliations of transactions can help identify any discrepancies and rectify them in a timely manner. By maintaining meticulous records and ensuring accurate reporting, businesses can mitigate the risk of errors, maintain compliance with GST regulations, and establish a smooth and transparent tax filing process.

-

Inaccurate Input Tax Credit (ITC) Claims:

Another common mistake taxpayers often must correct when filing GST returns is inaccurately claiming Input Tax Credit (ITC). ITC is a crucial benefit under the GST system, allowing businesses to claim credit for the GST paid on their purchases. However, incorrect or incomplete claims can lead to either underutilization or overutilization of credits, both of which can have negative consequences. Underutilization means missing out on eligible credits, resulting in increased costs for the business. On the other hand, overutilization of credits can lead to tax liabilities and penalties.

To avoid these pitfalls, businesses must diligently review and verify their eligibility for claiming ITC. Maintaining proper supporting documents such as invoices, receipts, and purchase records is essential, and reconciling them with the supplier’s auto-generated returns. This ensures that the claimed ITC aligns accurately with the transactions and complies with the GST laws. Implementing robust accounting systems and regularly monitoring ITC claims can help businesses avoid inaccuracies and optimise their tax benefits. By accurately claiming ITC, businesses can reduce their tax burden, improve cash flow, and enhance their financial performance.

-

Non-Compliance with Timelines:

Non-compliance with the prescribed timelines for filing GST returns is a common mistake made by taxpayers in India. GST returns have specific due dates, and failing to file returns within the stipulated time can result in penalties and interest charges.

To avoid this mistake, businesses must establish a robust monitoring system and adhere to the GST return filing deadlines. It is advisable to maintain a calendar or set reminders to ensure the timely submission of returns. Additionally, businesses can seek professional assistance or utilise reliable accounting software that offers timely reminders and automated filing features. By proactively managing timelines, businesses can mitigate the risk of penalties and maintain a good compliance record with tax authorities.

Timely filing of GST returns also helps businesses maintain smooth cash flow and avoid any disruptions in their operations. It is important to note that late filing of returns can also impact the recipient’s ability to claim Input Tax Credit (ITC) for purchases made. Therefore, maintaining a proactive approach toward meeting GST return filing deadlines is crucial for businesses to stay compliant and avoid unnecessary financial burdens.

-

Inadequate Reconciliation with E-Way Bills:

In the GST regime, businesses are required to generate and furnish electronic waybills, known as e-way bills, for the movement of goods exceeding a particular value. A common mistake taxpayers make is the inadequate reconciliation of e-way bill details with the GST returns. Please reconcile these records to avoid discrepancies, raising suspicion with tax authorities, and potentially leading to penalties.

To avoid this error, businesses must ensure that the information provided in the e-way bill aligns accurately with the corresponding details in the GST returns. Cross-verifying and reconciling data such as invoice numbers, taxable values, and correct GST rates is essential. Implementing a robust reconciliation process and utilising technology solutions or software that automatically matches e-way bill data with GST return data can significantly help minimise errors.

By ensuring proper reconciliation, businesses can maintain accurate and consistent records, reducing the risk of penalties and improving overall compliance. Timely and accurate reconciliation with e-way bills demonstrates adherence to the GST regulations and strengthens the trust between businesses and tax authorities, facilitating smoother trade operations.

-

Failure to Account for Reverse Charge Mechanism:

The reverse charge mechanism is a significant aspect of the GST system, where the liability to pay tax shifts from the supplier to the recipient of goods or services. However, many taxpayers need to pay more attention to the reverse charge mechanism when filing GST returns. This can result in underpayment or non-payment of GST, leading to potential penalties and legal consequences.

To avoid this mistake, businesses should diligently identify transactions that fall under the reverse charge mechanism and ensure that the appropriate tax liability is accounted for in their GST returns. Maintaining accurate records of such transactions, including invoices, additional interest payment vouchers, or any other supporting documents, is crucial.

Additionally, businesses should stay updated with the notifications and guidelines issued by the GST authorities to determine the reverse charge mechanism applicability correctly. By correctly accounting for the reverse charge mechanism, businesses can comply with the GST regulations, avoid unnecessary penalties, and ensure the accurate calculation of tax liabilities. Proactive measures, such as regular training of accounting personnel and the use of reliable accounting software, can help businesses effectively manage and account for transactions subject to the reverse charge mechanism.

-

Incorrect HSN/SAC Codes:

Harmonized System of Nomenclature (HSN) codes for goods and Services Accounting Codes (SAC) for services are numerical codes used to classify products and services for GST purposes. An all-too-common mistake taxpayers make when filing GST returns is assigning incorrect HSN or SAC codes. This error can lead to inaccuracies in tax calculations and may result in penalties or audits by tax authorities.

To avoid this mistake, businesses must accurately determine the appropriate HSN or SAC code for each product or service they deal with. It is crucial to stay updated with the latest HSN/SAC codes and guidelines provided by the GST authorities. Regular reviews and audits of the assigned codes can help identify and rectify any inaccuracies.

Additionally, utilising reliable accounting software that automatically assigns the correct codes based on product descriptions can streamline the process and minimise errors. By accurately reporting HSN/SAC codes in GST returns, businesses can maintain compliance, avoid penalties, and facilitate smooth interactions with tax authorities. Accurate classification of goods and services also ensures that the appropriate tax rates and exemptions are applied, promoting transparency and consistency in the GST filing process.

-

Incomplete or Incorrect Information in Invoices:

Incomplete or incorrect invoice information is a common mistake taxpayers make when filing GST returns. Invoices play a vital role in GST compliance, and any inaccuracies or omissions can result in discrepancies in the return. Businesses must ensure that their invoices contain complete and accurate information, including the supplier’s GSTIN, recipient’s GSTIN, invoice number, date, taxable value, and GST charged. Failure to include any of these details or providing incorrect information can lead to penalties and unwanted scrutiny from tax authorities.

To avoid this mistake, businesses should implement robust processes for generating and reviewing invoices. Utilising reliable accounting software that auto-generates invoices with the required details can help minimise errors. Regular internal audits and reconciliations between the invoices and the corresponding financial records can help identify and rectify discrepancies.

By ensuring the accuracy and completeness of invoices, businesses can maintain compliance with GST regulations, establish transparent and reliable business practices, and reduce the risk of penalties or audits related to invoice discrepancies.

-

Failure to Account for Exports and Imports:

One common mistake taxpayers make when filing GST returns is the failure to account for exports and imports accurately. GST regulations for international trade differ from those for domestic transactions, and businesses engaged in exports and imports must understand and comply with these specific rules. Pay attention to correctly accounting for exports and imports to avoid incorrect tax calculations, potentially resulting in penalties and additional liabilities.

To avoid this mistake, businesses involved in international trade must maintain proper documentation, including shipping bills, export invoices, and import bills of entry. It is essential to accurately record the details of export or import transactions in the GST return, ensuring that the tax liabilities are correctly calculated based on the applicable GST rates and exemptions.

Regular reviews and reconciliations of export and import-related records with the filed GST returns can help identify discrepancies and rectify them promptly. By accurately accounting for exports and imports, businesses can ensure compliance with GST regulations, facilitate seamless cross-border trade, and prevent any adverse consequences of incorrect tax calculations.

-

Neglecting to File Nil Returns:

A common mistake made by taxpayers when filing GST returns is the neglect to file nil returns when there are no transactions to report for a specific tax period. Even if a business has no activity or taxable supplies during a particular period, filing a nil return is mandatory under the GST regime. Neglecting to file nil returns can attract penalties and unnecessary scrutiny from tax authorities.

Businesses must maintain a record of each tax period and ensure that nil returns are filed within the prescribed due dates. This practice demonstrates compliance with GST regulations and helps maintain a clean compliance record. By filing nil returns, businesses also avoid potential complications in the future, such as the inability to claim input tax credits or disruptions in their operations due to non-compliance.

Implementing a systematic approach, including using accounting software or engaging professional services, can help businesses streamline filing nil returns and ensure adherence to the GST provisions. Even when there are no transactions, proactive compliance is crucial for maintaining a good standing with tax authorities and fostering a culture of responsible tax compliance.

-

Lack of Regular Review and Reconciliation:

A common mistake taxpayers make when filing GST returns is the need for regular review and reconciliation of financial records with the filed returns. This crucial step must be revised to avoid the accumulation of errors over time of filing, making it challenging to rectify them in the future. Businesses should establish a systematic review process to compare their financial data, including sales, purchases, expenses, and taxes, with the corresponding GST returns.

This helps in identifying any discrepancies, inconsistencies, or missing information. Regular reconciliations enable businesses to rectify errors promptly and ensure accurate reporting in the GST returns. It is crucial to address and resolve any discrepancies before the filing of return deadline to maintain compliance with the GST provisions. Implementing robust accounting systems, utilising reliable accounting software, and engaging professional assistance can streamline the review and reconciliation process.

By conducting regular reviews, businesses can minimise the risk of heavy penalties, avoid unnecessary audits, and demonstrate their commitment to accurate and transparent tax reporting. Regular review and reconciliation enhance compliance and provide businesses with valuable insights into their financial performance and help them make informed decisions based on accurate and up-to-date data.

Conclusion:

Filing GST returns accurately and timely is essential for businesses in India. By avoiding these common mistakes, taxpayers can ensure compliance with GST provisions, minimise the risk of penalties, and maintain a good reputation with tax authorities.

It is advisable to do GST Registration, seek professional guidance, invest in reliable accounting software, and establish robust processes for record-keeping and reconciliation. By doing so, businesses can navigate the GST regime effectively, capitalise on its benefits, and contribute to a transparent and efficient tax ecosystem in the country.

Legal251 has a team of specialists who will be with you every step of the way to make sure everything is done correctly and quickly. Download our App Legal251 or visit our website, www.legal251.com or dial the toll-free number – (+91) 77728-77729.